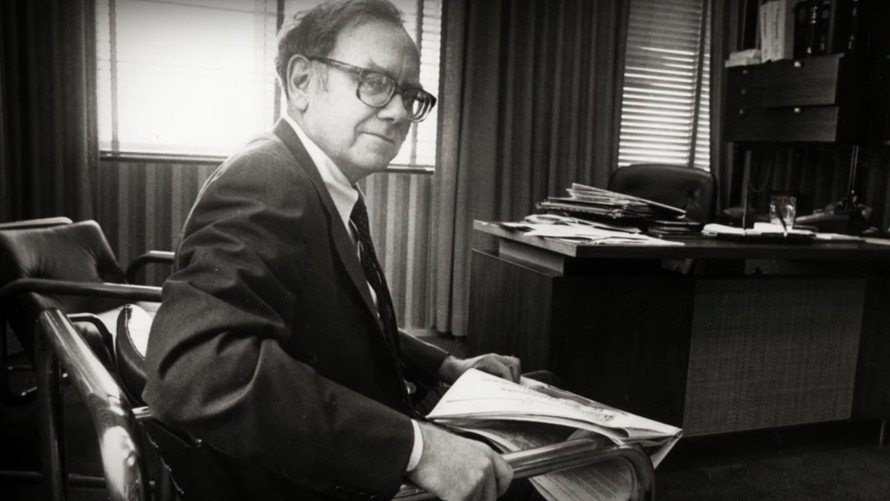

Warren Buffett age of 95 years marks an extraordinary milestone as the legendary investor officially retired as CEO of Berkshire Hathaway on January 1, 2026.

Born August 30, 1930, in Omaha, Nebraska, Buffett has spent nearly seven decades revolutionizing investment philosophy and building one of history’s most successful business empires.

Table of Contents

Quick Facts About Warren Buffett

| Category | Details |

|---|---|

| Full Name | Warren Edward Buffett |

| Date of Birth | August 30, 1930 |

| Age | 95 years old (as of January 2026) |

| Birthplace | Omaha, Nebraska, USA |

| Zodiac Sign | Virgo |

| Nickname | “Oracle of Omaha,” “Billionaire Next Door” |

| Nationality | American |

| Height | 5 feet 10 inches (178 cm) |

| Education | University of Nebraska (BS, 1950), Columbia University (MS Economics, 1951) |

| Occupation | Investor, Businessman, Philanthropist |

| Company | Berkshire Hathaway (Chairman, former CEO) |

| Years Active | 70+ years (1956-Present) |

| Net Worth | $148.9 billion (January 2026, Forbes) |

| World Ranking | 9th richest person globally |

| First Wife | Susan Thompson Buffett (m. 1952; d. 2004) |

| Current Wife | Astrid Menks (m. 2006) |

| Children | Susie Buffett, Howard Buffett, Peter Buffett |

| Investment Philosophy | Value investing, long-term holding |

| Famous Quote | “Be fearful when others are greedy and greedy when others are fearful” |

| Philanthropy | Pledged 99% of wealth to charity |

Warren Buffett’s Early Life and Childhood

Warren Edward Buffett entered the world on August 30, 1930, during the Great Depression in Omaha, Nebraska. His father, Howard Buffett, worked as a stockbroker and later became a U.S. congressman. His mother, Leila Stahl Buffett, managed the household and raised Warren alongside his two sisters, Doris and Roberta.

The economic hardships of the Depression era shaped young Warren’s perspective on money and investing. Even as a child, he displayed an extraordinary aptitude for numbers and business.

While other children played games, Warren studied stock charts and calculated compound interest rates in his head.

His father’s brokerage office became his second home. Warren spent countless hours in the customers’ lounge, observing traders and absorbing market movements. At age 10, his father took him to visit the New York Stock Exchange, an experience that solidified his fascination with financial markets and investing.

Warren Buffett Age and Education Journey

Warren Buffett’s educational path laid the groundwork for his investing genius. He attended Rose Hill Elementary School in Omaha before moving to Washington D.C. when his father won election to Congress.

This relocation proved challenging for young Warren, who struggled to adapt to new schools and make friends.

Despite social difficulties, his business acumen flourished. By age 11, Warren made his first stock purchase—buying three shares of Cities Service Preferred for $38 per share for himself and three for his sister Doris.

The stock dropped to $27, teaching him an early lesson about patience when it later recovered to $40 and he sold prematurely, only to watch it climb to $200.

At age 14, Warren invested $1,200 of his savings (equivalent to $21,434 today) in a 40-acre Nebraska farm worked by a tenant farmer. This investment generated steady rental income, demonstrating his understanding of income-producing assets at a remarkably young age.

By 15, he earned more than $175 monthly (equivalent to $3,057 today) delivering Washington Post newspapers—ironic given he would later invest heavily in the company.

He enrolled at the Wharton School of the University of Pennsylvania in 1947 due to parental pressure, though he preferred focusing on his business ventures.

After two years, he transferred to the University of Nebraska, graduating in 1951 with a Bachelor of Science in Business Administration. At age 19, he had already accumulated $9,800 (about $120,000 today) through various business ventures.

Harvard Business School rejected his application in spring 1950, a decision that redirected his path toward Columbia Business School. At Columbia, Warren studied under Benjamin Graham, the father of value investing. This mentorship proved transformative, shaping the investment philosophy that would define Buffett’s career.

He earned his Master of Science in Economics from Columbia in 1951 and briefly attended the New York Institute of Finance afterward.

Building the Foundation: Investment Career Beginnings

After graduation, 21-year-old Warren returned to Omaha and worked as an investment salesman at his father’s firm, Buffett-Falk & Co. He struggled initially, discovering that selling wasn’t his strength. His shyness and awkwardness made client interactions difficult, prompting him to take a Dale Carnegie public speaking course to overcome his fears.

In 1954, Benjamin Graham offered Warren a position at Graham-Newman Corp in New York for $12,000 annually. Warren accepted immediately, considering it the opportunity of a lifetime.

Working alongside his mentor, he refined his value investing approach and learned to identify undervalued securities with substantial margins of safety.

When Graham retired and closed his partnership in 1956, 25-year-old Warren returned to Omaha with $174,000 in savings. On May 1, 1956, he launched Buffett Partnership Ltd., starting with seven limited partners (mostly family and friends) who contributed $105,000.

Warren contributed just $100. His investment agreement promised partners 6% annually with all gains above that threshold going to him, and he would absorb the first 6% of any losses personally.

The partnership’s performance was exceptional. While the Dow Jones Industrial Average rose 74.3% over 13 years, Buffett Partnership Ltd. delivered 1,156%—nearly sixteen times the market return. Warren’s relentless focus on finding undervalued companies, combined with his discipline and patience, created extraordinary wealth for his partners and himself.

The Berkshire Hathaway Transformation

In 1962, Buffett began purchasing shares of Berkshire Hathaway, a struggling New England textile manufacturing company. The company was trading below its liquidation value, making it an attractive value investment. By 1965, he took control of the company after a dispute with management.

Buffett later called purchasing Berkshire Hathaway the “dumbest” investment decision of his career. The textile business had no future, yet he poured resources into it for nearly 20 years before finally shutting down the textile operations in 1985.

However, he transformed this “mistake” into his primary investment vehicle, using it to acquire insurance companies and other businesses.

The insurance operations became Berkshire’s golden goose. Insurance companies collect premiums upfront and pay claims later, creating “float”—money that can be invested in the meantime.

Buffett masterfully deployed this float into stocks and wholly-owned businesses, compounding returns at extraordinary rates. His first major insurance acquisition was National Indemnity in 1967, followed by GEICO (Government Employees Insurance Company) decades later.

Over six decades, Buffett transformed Berkshire Hathaway from a failing textile mill into a $1 trillion conglomerate. The company’s stock price has risen more than 5,500,000% since 1964, compared to the S&P 500’s 39,000% return over the same period.

Berkshire now ranks as the 11th most valuable company globally, with major holdings including BNSF Railway, GEICO, Dairy Queen, Duracell, Fruit of the Loom, and See’s Candies.

Investment Philosophy and Strategy

Warren Buffett’s investment approach centers on value investing principles learned from Benjamin Graham. His core philosophy emphasizes buying quality businesses at reasonable prices and holding them long-term. He seeks companies with strong competitive advantages (economic moats), excellent management, consistent earnings, and fair valuations.

His “invest in what you know” philosophy guides his stock selection. For decades, Buffett avoided technology companies because he didn’t understand their business models or competitive advantages.

This approach caused him to miss the early internet boom, but it also protected him from the dot-com crash. He famously stated, “Never invest in a business you cannot understand.”

Buffett’s patience distinguishes him from typical investors. He’s comfortable holding cash for years until attractive opportunities emerge. During the 2008 financial crisis, he deployed billions into Goldman Sachs, General Electric, and other quality companies trading at distressed prices.

These contrarian bets generated enormous profits when markets recovered.

His relationship with Apple demonstrates his evolution. Initially skeptical of technology, Buffett’s lieutenants bought nearly 10 million Apple shares in 2016. Recognizing the company’s ecosystem and customer loyalty, Buffett dramatically increased Berkshire’s position.

Apple became Berkshire’s largest holding, representing hundreds of billions in market value and validating his willingness to adapt.

Net Worth Evolution and Wealth Creation

As of January 2026, Warren Buffett’s net worth stands at $148.9 billion according to Forbes, making him the ninth-richest person globally.

His wealth journey demonstrates the extraordinary power of compound interest over extended periods. At age 30, he had accumulated approximately $1 million. By 32, he became a millionaire. At 56, he reached billionaire status in 1986.

The remarkable aspect of Buffett’s wealth is that approximately 95% was accumulated after age 65. When he turned 65 on August 30, 1995, his Berkshire stock was worth about $12 billion (about $25.3 billion adjusted for inflation). Over the next 30 years, his net worth increased nearly 12-fold to $150 billion despite donating over $60 billion to charity.

This wealth accumulation after traditional retirement age illustrates his famous principle: “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

His early investments compounded for decades, creating exponential growth in his later years. Between 1995 and 2025, Berkshire’s stock price grew nearly 30-fold, transforming his already substantial wealth into one of history’s largest fortunes.

Buffett’s 99% ownership stake in Berkshire Hathaway means his wealth fluctuates with the company’s stock price. In 2025, Berkshire’s Class A shares reached an all-time high of $809,350 before experiencing volatility.

They ended 2025 at $754,800, up 10.9% for the year. The more accessible Class B shares followed similar trajectories, demonstrating that Buffett’s fortune remains closely tied to his company’s performance.

Personal Life: The Unconventional Marriage Arrangement

Warren Buffett’s personal life proves as fascinating as his financial career. In 1950, while attending Columbia University, Warren met Susan Thompson through his sister Roberta, who was Susan’s Northwestern University roommate. Though both families knew each other from Omaha, this introduction sparked immediate interest.

Susan came from a middle-class Omaha family. Her father, William Thompson, worked as a minister, psychologist, and University of Nebraska-Omaha dean.

Despite Warren’s awkward courtship style—serenading her with his ukulele and bombarding her with attention—Susan fell in love with the ambitious young investor. They married on April 19, 1952, when Warren was 21 and Susan was 19.

The couple had three children: Susan Alice (Susie) born in 1953, Howard Graham born in 1954, and Peter Andrew born in 1958. Susan proved to be Warren’s emotional anchor during his early career struggles.

She provided the nurturing and social skills he lacked, hosting dinner parties and managing their household while Warren obsessed over investments.

However, by 1977, after 25 years of marriage, Susan felt unfulfilled. Warren’s singular focus on business left little room for emotional intimacy. She yearned to pursue her passion for singing and activism for civil rights and women’s reproductive rights. That year, Susan made the difficult decision to move to San Francisco to pursue her music career and personal growth.

This separation could have ended their marriage, but instead, it evolved into something uniquely unconventional. Susan and Warren never divorced and remained deeply connected.

They spoke almost daily by phone, traveled together for holidays and special occasions, and continued their emotional bond despite living 2,000 miles apart.

Astrid Menks: The Second Partner

Before leaving Omaha, Susan introduced Warren to Astrid Menks, a Latvian immigrant working as a hostess at the French Café where Susan occasionally performed.

Understanding that Warren couldn’t manage basic daily tasks like cooking or laundry, Susan asked Astrid, “Will you take Warren, make him some soup, go over there and look after him?”

Astrid agreed and moved into Warren’s Omaha home in 1978. Born in 1946 in Latvia, Astrid was 16 years younger than Warren and represented a stark contrast to Susan’s outgoing personality. Quiet, private, and content living simply, Astrid perfectly complemented Warren’s famously frugal lifestyle and intense work focus.

What could have been a complicated love triangle instead became a remarkably harmonious arrangement. Susan, Warren, and Astrid maintained close relationships for nearly three decades.

They even signed joint Christmas cards “Warren, Susie, and Astrid,” symbolizing their unique family structure. Friends and family accepted the arrangement, recognizing that all three adults were happy and nobody was being hurt.

Warren once explained, “Susie put me together, and Astrid keeps me together.” Susan provided the emotional foundation that shaped his character, while Astrid offered the daily stability allowing him to focus entirely on Berkshire Hathaway. His daughter Susie defended the arrangement publicly, stating, “Unconventional is not a bad thing. More people should have unconventional marriages.”

In October 2003, Susan was diagnosed with oral cancer. She underwent surgery, radiation therapy, and facial reconstruction. Warren flew from Omaha to San Francisco every weekend to be with her during recovery.

The couple contributed $6 million to five California doctors for oral cancer research. Susan recovered enough to attend Berkshire’s May 2004 annual shareholders meeting, where she led a singalong at the Borsheim’s reception.

Tragically, on July 29, 2004, Susan suffered a cerebral hemorrhage while in Cody, Wyoming, and passed away at age 72. Warren was devastated, losing not just his wife but his lifelong confidante and the person who had shaped him emotionally. He was so heartbroken that he couldn’t attend her funeral.

Two years later, on August 30, 2006—Warren’s 76th birthday—he married Astrid in a quiet civil ceremony at his daughter Susie’s home. After 28 years together, they finally formalized their relationship.

The wedding reflected their modest lifestyle: no grand celebration, no publicity, just a simple ceremony formalizing what had long been reality.

Partnership with Charlie Munger

No discussion of Warren Buffett’s life is complete without Charlie Munger, his business partner and closest friend for over six decades.

They met at a dinner party in Omaha in 1961, introduced by mutual acquaintances. Both were Omaha natives with sharp intellects and shared values, though their personalities differed.

Charlie, a Los Angeles lawyer turned investor, was more blunt and acerbic than Warren. Where Warren could be diplomatic, Charlie delivered unvarnished truth.

Their intellectual partnership transformed both men. Charlie pushed Warren beyond Graham’s strict value investing toward buying excellent businesses at fair prices rather than mediocre businesses at cheap prices.

Their relationship featured constant debate and discussion but never arguments. Warren once said, “Charlie and I have never had an argument in 60 years.

We’ve had differences, but never an argument.” Charlie served as Berkshire’s vice chairman and appeared alongside Warren at the company’s legendary annual shareholder meetings, dubbed “Woodstock for Capitalists.”

These meetings drew tens of thousands of investors to Omaha each spring. Warren and Charlie would sit on stage for hours answering questions about investing, business, economics, and life.

Their wisdom, humor, and genuine friendship made these events legendary in the investment world. Charlie’s witticisms became as famous as Warren’s, with memorable quotes like “Show me the incentive and I’ll show you the outcome.”

On November 28, 2023, Charlie Munger passed away at age 99, just weeks before his 100th birthday. His death marked the end of an era. Warren mourned the loss of his “closest pal for 64 years,” acknowledging that Berkshire wouldn’t have achieved its success without Charlie’s influence.

At the 2024 shareholders meeting, Warren held a moment of silence for Charlie, visibly emotional as he reflected on their extraordinary partnership.

Philanthropy and The Giving Pledge

Warren Buffett’s approach to wealth is as unconventional as his personal life. Despite being one of history’s richest individuals, he lives in the same modest Omaha house he purchased in 1958 for $31,500 (now worth about $350,000). He drives modest cars, eats at McDonald’s for breakfast, and famously drinks five Cokes daily.

His frugality isn’t about deprivation but priorities. Buffett believes accumulated wealth should benefit society rather than fund personal extravagance.

In June 2006, he announced plans to donate more than 80% of his wealth to charitable foundations. He later increased this commitment to 99%, declaring that virtually all his wealth would eventually go to philanthropy.

The main beneficiary has been the Bill & Melinda Gates Foundation, which focuses on global health and education. Buffett’s friendship with Bill Gates began in the early 1990s and deepened over decades.

Despite initial reluctance to meet (“What would we possibly have to talk about?”), they discovered shared interests and values. Their friendship proved so strong that Buffett entrusted Gates with distributing most of his fortune.

In 2010, Buffett and Bill Gates created The Giving Pledge, inviting billionaires worldwide to commit at least half their wealth to charitable causes. The initiative has enrolled hundreds of wealthy individuals, collectively pledging hundreds of billions to philanthropy. Buffett’s philosophy is simple: “If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.”

By 2026, Buffett has donated over $60 billion worth of Berkshire stock to charitable foundations. His current donation strategy involves annual gifts converting Berkshire Class A shares into Class B shares for distribution.

These donations have reduced his Berkshire ownership from nearly 40% to approximately 14%, yet his remaining stake is still worth over $140 billion.

Additional charitable recipients include foundations run by his three children—the Susan Thompson Buffett Foundation (named for his late wife, focusing on reproductive rights and college scholarships), the Howard G. Buffett Foundation (focusing on agriculture and food security), the Sherwood Foundation (education and social justice), and the NoVo Foundation (empowering girls and women).

CEO Retirement and Succession Planning

At the May 2025 Berkshire Hathaway annual shareholders meeting, Warren Buffett announced his intention to retire as CEO at year’s end. This announcement wasn’t surprising—he had been preparing for succession for years. In 2021, he publicly named Greg Abel as his successor. Abel, 63, had served as vice chairman of non-insurance operations since 2018.

On January 1, 2026, at age 95, Warren officially retired as CEO after an unprecedented 60-year tenure. Greg Abel assumed the CEO role, marking the end of an era.

However, Warren remains Berkshire’s chairman and retains his 30% voting control through Class A shares. He plans to continue coming to the office regularly and will be available for consultation.

Warren’s retirement statement emphasized his confidence in Abel and Berkshire’s leadership team. He’s spent decades ensuring the company could thrive without him.

Berkshire’s decentralized structure, with subsidiary managers operating independently, minimizes disruption from leadership changes. Warren built systems and culture designed to outlast any individual, including himself.

In his poignant Thanksgiving 2025 letter to shareholders, Warren acknowledged mortality: “Father Time is in the neighborhood.” At 95, he recognized the importance of formal succession while he could still provide guidance.

His retirement reflects careful planning rather than forced circumstances, allowing a smooth transition preserving Berkshire’s culture and values.

Health and Lifestyle at 95

Warren Buffett’s longevity and vitality at 95 are remarkable. He credits good genes—his mother lived to 92—and a positive attitude for his endurance.

His daily routine hasn’t changed much despite retirement from the CEO role. He still arrives at his modest office around 8:30 AM and spends hours reading annual reports, newspapers, and business publications.

His diet famously contradicts modern health advice. He consumes enormous amounts of Coca-Cola (five cans daily), eats McDonald’s breakfast regularly, and indulges in See’s Candies products. He once joked, “I checked the actuarial tables, and the lowest death rate is for six-year-olds.

So I decided to eat like a six-year-old.” Despite this unusual diet, he has remained mentally sharp and physically active into his mid-90s.

Buffett underwent prostate cancer treatment in 2012, receiving radiation therapy that successfully eliminated the cancer. His recovery was complete, and the illness didn’t significantly impact his work schedule.

He continues playing bridge online for hours each week, maintaining his competitive edge and keeping his mind sharp through strategic game play.

His mental acuity remains extraordinary. At Berkshire’s annual meetings, he answers complex financial questions without notes, recalling specific details from deals made decades ago.

His wit and humor remain sharp, entertaining shareholders with folksy wisdom and self-deprecating jokes. Friends and colleagues report no significant cognitive decline despite his advanced age.

Legacy and Cultural Impact

Warren Buffett’s influence extends far beyond finance. He revolutionized investment philosophy, proving that patience, discipline, and rational thinking could generate extraordinary wealth.

His success validated value investing and demonstrated that beating the market was possible with the right approach.

His writing style transformed corporate communications. Berkshire Hathaway’s annual shareholder letters are studied by business students worldwide. Written in clear, conversational language with humor and honesty, they explain complex financial concepts accessibly.

Buffett refuses corporate jargon, believing transparency and simplicity build trust with shareholders.

Buffett’s “invest in what you know” philosophy democratized investing. By encouraging ordinary people to understand businesses before buying stocks, he empowered individual investors to make informed decisions. His advocacy for low-cost index funds over active management helped millions preserve wealth that would otherwise be consumed by fees.

His modest lifestyle challenges the notion that wealth requires ostentation. Living in the same house for 65+ years, eating at modest restaurants, and avoiding private jets (until business necessity dictated otherwise) demonstrates that success doesn’t demand conspicuous consumption.

This “billionaire next door” image made him relatable to average Americans.

The annual Berkshire Hathaway shareholders meeting became a pilgrimage for investors worldwide. Dubbed “Woodstock for Capitalists,” it attracted 40,000+ attendees eager to hear Warren’s wisdom. His willingness to share knowledge freely, answer questions for hours, and make investing accessible created a devoted following spanning generations.

Current Life and Activities in 2026

At 95, Warren Buffett remains engaged with Berkshire Hathaway despite stepping down as CEO. As chairman, he attends board meetings, reviews major decisions, and provides strategic guidance to Greg Abel.

His presence offers continuity and reassurance to shareholders concerned about post-Buffett Berkshire.

He continues living in his modest Omaha home with wife Astrid Menks. His daily routine includes reading multiple newspapers cover-to-cover, studying corporate reports, playing bridge online, and discussing business with friends and colleagues. He remains intellectually curious and actively engaged with current events and economic trends.

His philanthropic work continues accelerating. In June 2024, he made his largest annual donation yet—$6 billion to his five chosen charities.

These donations progressively reduce his Berkshire holdings while massively expanding foundation resources. He’s stated his intention to donate virtually all remaining wealth before or shortly after his death, estimated at $140+ billion.

Buffett maintains his sense of humor about aging. When asked about retirement, he quipped, “I tap dance to work.” He views each day as a gift and approaches life with gratitude rather than regret. His advice to others emphasizes doing what you love and maintaining meaningful relationships over accumulating possessions.

Business Lessons and Wisdom

Warren Buffett’s career offers countless lessons for investors and businesspeople. His emphasis on long-term thinking counters the market’s short-term focus. He famously said, “The stock market is a device for transferring money from the impatient to the patient.” This principle helped him avoid panicking during market downturns and capitalize on others’ fear.

His focus on competitive advantages (economic moats) guides business evaluation. He seeks companies with durable competitive positions protected by brand strength, network effects, cost advantages, or switching costs.

These moats allow businesses to generate consistent profits for decades, creating compounding wealth.

Buffett’s candor about mistakes separates him from typical CEOs who spin failures positively. He openly admits buying Berkshire Hathaway was foolish, overpaying for various acquisitions, and missing obvious opportunities like Amazon and Google.

This intellectual honesty builds credibility and demonstrates continuous learning.

His emphasis on management quality recognizes that great businesses require great leaders. He looks for managers who treat shareholders’ money as their own, allocate capital wisely, and operate with integrity. Once he trusts management, he leaves them alone to run their businesses without interference.

Buffett’s advice to ordinary investors is remarkably simple: buy low-cost index funds and hold them for decades.

He’s consistently stated that most people shouldn’t pick individual stocks but should instead own the entire market through index funds. His humility about his own irreplaceability contrasts with typical Wall Street arrogance.

Frequently Asked Questions (FAQs)

How old is Warren Buffett in 2026?

Warren Buffett is 95 years old as of January 2026, having been born on August 30, 1930. Despite his advanced age, he remained Berkshire Hathaway’s CEO until January 1, 2026, when he officially retired and passed leadership to Greg Abel.

What is Warren Buffett’s net worth in 2026?

Warren Buffett’s net worth is approximately $148.9 billion as of January 2026, making him the ninth-richest person globally according to Forbes. Despite donating over $60 billion to charity, his remaining Berkshire Hathaway stake continues appreciating in value.

Is Warren Buffett still married?

Yes, Warren Buffett is married to Astrid Menks, whom he wed in 2006. They had been together since 1978 when Astrid moved in with him following his separation from first wife Susan Thompson Buffett, who passed away in 2004.

When did Warren Buffett retire as CEO?

Warren Buffett officially retired as Berkshire Hathaway’s CEO on January 1, 2026, at age 95, after serving 60 years in the role. He remains chairman of the board and continues advising the company, with Greg Abel assuming the CEO position.

How did Warren Buffett make his money?

Warren Buffett made his fortune through value investing—buying undervalued stocks and quality businesses at reasonable prices and holding them long-term. He used Berkshire Hathaway as his investment vehicle, transforming a failing textile company into a $1 trillion conglomerate.

What is Warren Buffett’s investment strategy?

Buffett’s investment strategy centers on value investing: buying quality businesses with strong competitive advantages, excellent management, and consistent earnings at fair prices. He emphasizes long-term holding, patience, discipline, and understanding businesses before investing.

Who is Astrid Menks?

Astrid Menks is Warren Buffett’s second wife, whom he married in 2006. Born in Latvia in 1946, she met Warren in 1978 through his first wife Susan, who introduced them before moving to San Francisco. Astrid has lived with Warren since 1978.

Did Warren Buffett have children?

Yes, Warren Buffett has three children with his first wife Susan Thompson Buffett: daughter Susan Alice (Susie) born 1953, son Howard Graham born 1954, and son Peter Andrew born 1958. All three children run charitable foundations funded by their father’s wealth.

How much has Warren Buffett donated to charity?

Warren Buffett has donated over $60 billion to charitable foundations since 2006, primarily to the Bill & Melinda Gates Foundation and four family foundations. He has pledged 99% of his wealth to charity, with most donations going to these causes.

What companies does Berkshire Hathaway own?

Berkshire Hathaway owns numerous companies including GEICO insurance, BNSF Railway, Dairy Queen, Duracell, Fruit of the Loom, See’s Candies, and substantial stakes in public companies like Apple, Bank of America, Coca-Cola, and American Express.

Conclusion

Warren Buffett age of 95 years in 2026 represents an extraordinary life spanning nearly a century of American capitalism. From buying his first stock at age 11 to retiring as CEO of a $1 trillion conglomerate at 95, his journey embodies the power of compound interest, patience, and disciplined investing.

His net worth of $148.9 billion—95% accumulated after age 65—demonstrates that wealth creation can accelerate dramatically in later years when investments have decades to compound.

Beyond financial success, Buffett’s unconventional personal life with first wife Susan Thompson and second wife Astrid Menks reveals a man who valued loyalty, understanding, and mutual respect over traditional conventions.

His 52-year marriage to Susan, maintained even during their 27-year physical separation, and his 28-year partnership with Astrid before marriage, challenged societal norms while working perfectly for everyone involved.

As he officially retired from the CEO role on January 1, 2026, passing leadership to Greg Abel, Buffett completed six decades of transforming Berkshire Hathaway from a failing textile mill into one of the world’s most valuable companies.